I’ve said it before that Disney has refined the art of extracting money from its guests. So it stands to reason that they would not miss out on the opportunity to sell you a timeshare. Disney Vacation Club is their “best kept secret” and you’ll see signs for it EVERYWHERE.

But there is NO hard sell. Even though there are signs in/on the busses, kiosks in every resort and in every Park, and even references to DVC scattered everywhere else, and even if YOU call THEM asking for information, they simply have more demand than they have slots available. So you won’t get any real pressure to buy. The result is that there’s a lot of confusion and misinformation out there as to what DVC is all about.

[Disclaimer: I’m not a DVC member. I’ve considered it heavily and haven’t yet decided whether to buy-in.]

DVC in a Nutshell

Like any other timeshare, DVC is the selling of a time-limited real estate interest, with an annual fee and restrictions on use. Starting from a determination of how long you typically like to stay at a Disney property, which resort you prefer over others (called your Home Resort) and your desired room size, Disney tells you how many DVC “Vacation Points” you will need to stay for that term, at that resort, every year of your membership. You pay an initial fee to join, which is calculated based on how many DVC points you want, buying into the Home Resort.

Then you pay an annual fee (also based per-point). You continue to pay the annual fee for the length of your membership (not more than 50 years). At the end of your membership, unless Disney decides to extend it, your DVC membership simply terminates and you have NO residual ownership interest (we haven’t yet reached the 50 year mile marker for any of the DVC resorts, so we don’t yet know exactly what they’ll do, but based on some behaviors over the last few years, they seem to be extending the terms of many of the resorts so far).

DVC Resorts

Today, there are 13 DVC resorts world-wide. Nine are at Walt Disney World, one is at Disneyland, one is in Hawaii, one is in Vero Beach and one is in Hilton Head. Even if you want to usually visit a Disney Theme Park, you can still decide to have your Home Resort somewhere else. The only difference is that your ability to reserve space at your Home Resort is a little better than at other resorts (people get first dibs on space in their Home Resort by being able to book sooner than at the other resorts).

All of the DVC Resorts are Deluxe-level accommodations. In most cases, they start with a “deluxe studio” size and go up from there to a 3-room suite. DVC suites can accommodate up to 12 people in some cases, so it’s entirely possible that DVC membership could save you money (see below) on your Disney vacation. BUT, be careful. Room sizes vary drastically depending on the resort. For example, a deluxe studio at Bay Lake Tower is ~339sqft, and the same room style is ~412sqft at BoardWalk Villas. Compare this to a “standard” room at the Contemporary at ~394sqft (which doesn’t have the “kitchenette” in the studio room, which takes up a significant amount of that space), making the rooms feel MUCH smaller at Bay Lake Tower.

But, and this is a weird but, there IS a catch. Mousekeeping (housekeeping) doesn’t come every day. They don’t even come every other day. In a week-long stay (less than 8 nights), they come 1x for “trash and towel service,” which is EXACTLY what they provide. They remove the trash from the trashcans and they leave a pile of blankets and towels for you to change your own linens on your bed(s). Only on night 8 of a single stay will they actually come and clean the room.

In addition, they technically are supposed to SELL you additional shampoo/conditioner if you run out of the allotted one little bottle of each. Granted, it sounds like they will give you more if you ask without a problem. But to me, it’s the principle of the thing. There’s even a little menu of available items for purchase left in your room.

Really, the thing to remember is that DVC is like you are staying at your own home. There’s a little kitchen, you change your own sheets and vacuum your own floors (there is a vacuum in the closet). You get a price break for this (even renting points) – but some folks feel that if they’re on vacation, they don’t want to be doing these types of housekeeping chores. You can always pay Disney to come clean the room, too, but of course, it’s relatively expensive and quickly eats up the cost savings.

Points and Fees

Because there are three variables at play (how long you like to vacation, which resort(s) you like to stay at, and what size room you will want while you’re there), it’s impossible for me to exactly tell you what your Initial Fee and Annual Point costs will be. Disney shows an example on their DVC site so you can readily see the math. It’s pretty straight-forward. The nicer the resort, the more points it takes to stay for a single night. The nicer/larger the room you want, the more points it takes to stay for a single night. Add those together to figure out how many points you will need to have the Disney Vacation you’ll want. Do some checking to see what that point quantity will also get you at OTHER DVC resorts, just in case you will want to stay at a different resort some time.

Keep in mind that the Initial Fee is a one-time purchase price. This fee is never refunded and while it IS a real estate interest that you can devise or sell, Disney has rules regarding its sale. Also, at the end of your DVC term (again, 50 years max as of today, and in many cases that number is already smaller because it’s 50 years from the opening of the specific resort you choose as your Home Resort), your membership ends and you do NOT get a single penny of that Initial Fee back in any way. The Annual Points are ON TOP of the Initial Fee (even in the first year). You pay this Annual Point fee up-front each year, even if you don’t plan to use the Points to take a vacation that year.

Banking and Borrowing Points

Just because you don’t plan to take a vacation doesn’t mean you have to lose your Points. Disney allows you to bank a whole year of Points AND/OR borrow up to a whole year of Points as well. So when you’re thinking about your initial buy-in, consider how often you plan to vacation. If you’re only going to Disney every 3 years, you can actually get away with only buying 1/3rd the quantity of Points you would normally need. Bank a year, borrow a year, and add both to the current year. You then have 3x the Points you usually would. Skip two years and do it again.

Renting Points

In additional to Banking and Borrowing, you can rent your Points to other people in the event you don’t need them in a given year. You can go direct – advertising your Points availability to the general world via the Internet, or you can go through a Point broker like David’s Vacation Club Rentals. David handles all of the paperwork and as a result, you get a dollar/point less (or so). But it could be worth it to handle the details and get it done right. On the flip-side, you can also rent additional points through a broker (or direct) to add to your Points to get a better resort quality, room size or length of stay.

Let’s Do Some Math (as of May, 2021)

For the Villas at the Grand Floridian (V@GF), the base price is $255/point (in 2014, it was $150), with a minimum of 100 points. So your initial MINIMUM buy-in to the resort is $25,500. A week at a Studio (the smallest room) at the V@GF in June, though, for example, is 167 points. So the buy-in necessary to have at least that many points is $42,585. Your DVC membership will end on 1/31/2064. On top of that, you’ll have Annual Point costs of $5.41/point ($1,095.52 on 167 points). Do some quick math and you see that there are 43 years from now until the end of the DVC membership you’ve purchased. Assuming annual point costs don’t increase (but they do), that would result in total cost of $47,107.36. Add that to the buy-in above and you get $89,692.36. Divide that back by 43 and you get an annual expense of $2,085.87. Or, about $347.64/night for 6 nights (it was about $218 in 2014).

If you think you’ll spend at least $2,085.87 EVERY YEAR at a Disney resort (or a vacation club resort that has reciprocity)… you have STARTED to make a DVC membership seem right for you. Keep in mind that this doesn’t include travel, food, Park Tickets or anything other than the room itself. It also doesn’t include any increases in the Annual Point Maintenance cost (the average increase was about 4.2%/year – it varies based on your home resort).

A week in a standard one-bedroom at the Grand Floridian, on the other hand, is 319 points, a two-bedroom, 454. A Lake studio 192 points, a lake one-bed 394, a two-bed 538 and a Grand Villa 1091. Respectively, this works out to the chart below:

| Room Type | Points | Buyin | Annual Pt | 43yr Total | Annual $ | Per night |

| Std 1 bed | 319 | $ 81,345 | $ 2,093 | $ 89,984 | $ 3,984 | $ 664 |

| Std 2 bed | 454 | $ 115,770 | $ 2,978 | $ 128,064 | $ 5,671 | $ 945 |

| Lake Studio | 192 | $ 48,960 | $ 1,260 | $ 54,159 | $ 2,398 | $ 400 |

| Lake 1 bed | 394 | $ 100,470 | $ 2,585 | $ 111,140 | $ 4,921 | $ 820 |

| Lake 2 bed | 538 | $ 137,190 | $ 3,529 | $ 151,759 | $ 6,720 | $ 1,120 |

| Lake GV | 1091 | $ 278,205 | $ 7,157 | $ 307,749 | $ 13,627 | $ 2,271 |

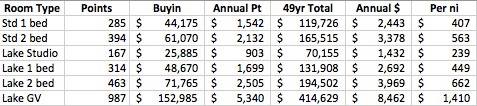

For comparison’s sake, below is the table of the same calculations I did from 2014 – note what has happened in the intervening 7 years:

What you REALLY don’t want to think about is the cost of Park Tickets for this potential 43 year set of trips. At today’s cost, for a family of 4 (2 adults and 2 kids 3-9), base Standard Theme Park tickets are $1,948.96 for 6 days in the parks without ANY options (no hopping, no water parks). If Disney keeps these costs from rising for the duration, you’d spend $83,805.28 in tickets alone.

But that’s not realistic. Disney has been increasing their costs by about 10%/year for theme park tickets. It’s interesting to do the math. It comes out to (sit down for this): $1,154,565.25. Yes, $1.1M (on average, that’s $1,118.76/person/day). This is not sustainable, of course – it outpaces inflation significantly. So this number isn’t realistic, either. It illustrates, however, that you need to consider whether you can afford the park tickets. And that you’ll be tied to Disney whether you can afford them or not (of course, you can sell your DVC membership, but that’s a whole other issue).

Benefits

A DVC membership has some benefits – discounts at the Parks, discounts on golf and merchandise, Annual Pass discounts, etcetera. But the real benefit is in the cost if you were already going to be taking a Disney vacation.

As stated above, that V@GF room was $347.64/ni. This is a significant bargain when compared to the usual cost for a room of that type at the Grand Floridian. As of today, a standard room at GF is $737.83/night for a week in June and a one-bedroom suite is $1,678. So on the DVC plan, the key is that they are giving you a discount for consistent returns. But the flip-side is that if you don’t need the deluxe level of accommodations (which many don’t), you can stay much more cheaply. Comparatively speaking, for example, every other Deluxe resort in that time frame is available for < $600/night. Moderates are available from $256/night and Values are available from $169.83/night.

So again, if you’re already going to be visiting Disney that frequently, and you have a certain level of room that you can’t live without, DVC might be something to consider.

Resale

It is also possible to buy into the DVC, or add points to an existing membership, on the secondary market. You lose some of the perks because Disney prefers to sell you the Points directly. Research this heavily to see if it would matter to you.

Using Points for a Cruise or to stay at another Resort

Points can be redeemed for a Disney Cruise. But they aren’t nearly as powerful. For example, a 7-night Cruise on the Fantasy requires 278-286 points (in Peak Season – the same time of year as my calculations above) just for the LOWEST room class, a Category 11, Standard Inside Stateroom. To get to a stateroom with a full-size verandah (Category 6), you need 352-357 points. And these point values are PER PERSON!!! So, for a family of four, Category 6, you need about (using averages): 1418 points – the same number of points for 3-years’ worth of Lake 2-bed at V@GF. Dollar wise, that’s $3,969*3 = $11,907. Alternatively, paying cash for that same cruise today is $6,456.88 – or a loss of $5,451 by using points. So in short, you should almost NEVER use DVC points to go on a cruise.

Assuming your Home Resort is V@GF, maybe you want to go to Aulani in Hawaii. And here, things look a little brighter. You can go for as little as 117 points for a week in “Adventure Season” in a hotel room. And 154 points for that same room in “Premier Season”. But if you want a bigger room, things get pricier the better the view – up to 1288 points for a 3-bed ocean-view villa. Now, granted, that sleeps 12, so you can bring a LOT of friends for that at no “additional” cost.

Final Evaluation

You have to do this complete analysis for yourself and your family. The more people in your family that go with you on trips, the better the potential value because you don’t have to house them all individually. The more you think you’re going to go to Disney, the better the value, too. And if you can play the “banked points” game to get to have some really awesome concierge-level fun, and are willing to go every 3 years instead, you could really come out ahead.

For many people, though, the initial buy-in is the killer factor. Disney will offer to connect you with folks who can finance it for a certain period of time. This isn’t a good idea. Fiscally speaking, you should only join DVC if you can pay cash for the buy-in. Additionally, I hesitate on timeshares that have a reversion (the 50-year term limit, after which “ownership” reverts to Disney). So buying resale is a possibility for some folks, too, but you lose some of the perks (Disney wants to sell direct, but knows they can’t prevent the grey market, so they take away some of the minor privileges).

Lastly, consider the following alternative as well: If you were going to buy a significant number of points or a smaller number of points at a higher-value site, say at the Polynesian or Grand Floridian, and you have the financial resources to pay cash for the Buy-In, you may want to invest that money instead. With a 5% return on a $100,000 investment, you’d receive $5,000/year in interest. Keep the $100K invested and spend the interest – it’s like going to Disney for free. Granted, I’m neither a tax nor investment counselor – so you should ALWAYS talk with your advisors before making any kind of investment decision (and a DVC membership, as members like to say, is a form of investment).